|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Exploring the Best 90 Mortgage Deals for Your NeedsUnderstanding 90% MortgagesWhen you're looking to buy a home, a 90% mortgage might be an attractive option. These deals allow you to borrow up to 90% of the property's value, meaning you'll need a 10% deposit. This can be beneficial if you're eager to enter the housing market but don't have a substantial down payment. Benefits of 90% Mortgages

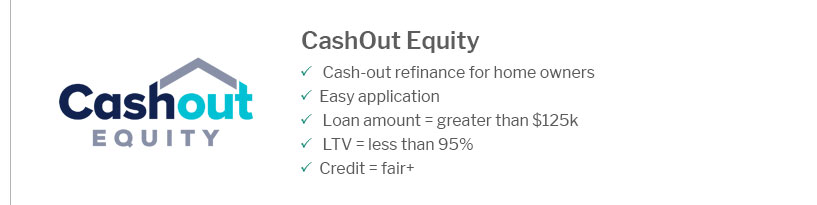

Factors to ConsiderInterest RatesThe interest rate is a crucial factor that impacts the overall cost of your mortgage. Compare rates carefully to find the most affordable option. For those considering refinancing options, checking mortgage refinance rates utah might provide useful insights. Lender CriteriaDifferent lenders have varying criteria for approving 90% mortgages. It's important to understand these requirements and ensure you meet them before applying. Repayment Terms

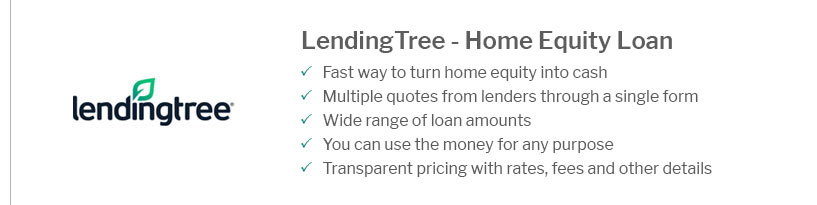

Comparing DealsWhen searching for the best 90 mortgage deals, it's essential to compare all available offers. Use online comparison tools, speak with mortgage advisors, and don't forget to consider alternative options like the best heloc rates tn for accessing home equity. FAQ Section

https://www.natwest.com/mortgages/mortgage-comparison/90-percent-mortgages.html

Other mortgage types and rates. Fixed ... https://www.habito.com/mortgage-comparison/90-ltv

See the best rates out there for 90% LTV mortgages. This tool will show you the top rates, but can't tell you if you're eligible for them. https://www.cnbc.com/select/best-mortgages-seniors/

Discover boasts lower-than-average rates on home equity loans and accepts a 90% combined loan-to-value ratio, higher than many other lenders.

|

|---|